Why Should You Invest in Mutual Funds?

Diversification

Your money is spread across a range of assets, reducing the impact if one investment performs poorly.

Professional Expertise

Skilled fund managers backed by research teams make investment decisions, so you don’t have to be a market expert.

Affordability

You can start investing with as little as ₹100 through a Systematic Investment Plan (SIP).

Liquidity

Most mutual funds (especially open-ended ones) allow you to redeem your investment easily whenever needed.

Transparency

Mutual fund houses regularly disclose portfolio holdings, NAV, returns, and risks, ensuring you stay informed.

Flexibility

Choose from a wide variety of funds based on your risk profile, financial goals, and investment horizon.

Types of Mutual Fund

Equity Funds

Equity funds invest in stocks and offer high risk with high return potential. They include large-cap, mid-cap, small-cap, sectoral/thematic, and dividend yield funds.

Debt Funds

Debt funds invest in fixed-income instruments like bonds and treasury bills. They carry lower risk than equity funds and include liquid, bond, gilt, and credit risk funds.

Hybrid Funds

Hybrid funds combine equity and debt, balancing risk and return. Types include aggressive (more equity), conservative (more debt), and dynamic asset allocation funds.

Money Market Funds

Money market funds invest in short-term, low-risk instruments like T-bills and commercial paper. They offer low returns but high liquidity.

Commodity Funds

Commodity funds invest in assets like gold, silver, and oil, with gold ETFs being especially popular.

Real Estate Funds (REITs)

Real estate funds (REITs) invest in property assets through Real Estate Investment Trusts, offering exposure to real estate without direct ownership.

Why Choose Us for Your Mutual Fund Investments?

At Pinnacle, we believe that wealth creation should be simple, accessible, and transparent. When you invest with us, you benefit from:

- Seamless online transactions with 100% security

- Access from website and mobile app

- Access to entire universe of mutual fund in India

Our Core Values

Transparency : No hidden fees, no sales gimmicks — just clear, honest investing.

Education : We don't just help you invest — we help you understand why.

Security : Your data and investments are fully encrypted and securely stored.

AMC LIST

Different Ways to Invest in Mutual Funds?

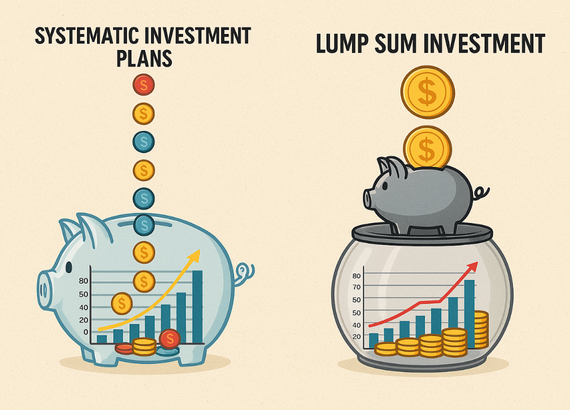

Systematic Investment Plans (SIPs) and LumpSum Investments:

Systematic Investment Plan (SIP):SIP allows you to invest a fixed amount monthly into a mutual fund. This method helps you build your investment gradually while averaging out market ups and downs over time

Lumpsum- Lumpsum investment involves putting a large amount of money into a mutual fund in one go.

Which to Choose?

The choice between a one-time investment and SIPs depends on your financial goals, risk appetite and time preferences. SIPs offer regular,disciplined investing, while lumpsum investments suit those with a large amount at hand and potentially better market timing.

How to access MF via Pinnacle?

Questions? We have you covered.

What is a mutual fund in simple terms?

A mutual fund pools money from many investors to invest in assets like stocks or bonds. Profits or losses are shared among all investors.

Is it safe to invest in mutual funds?

Yes. Mutual funds are regulated by SEBI. While returns aren’t guaranteed, your investments are professionally managed.

What if I need to withdraw?

Most mutual funds (except ELSS) are easy to redeem. Funds are typically credited to your bank within 1–3 business days.

Are Mutual Funds Taxable?

Yes, mutual funds are subject to taxation in two main ways:

Capital Gains Tax: If you sell your mutual fund units at a profit, the gain is taxable.

Fund-Level Capital Gains Distribution: Even if you don’t sell your mutual fund, you may owe taxes if the fund itself sells securities at a profit and distributes those gains to you.

For further clarification, please consult your tax advisor or financial consultant.

What Happens if You Withdraw After 1 Year?

**Equity Mutual Funds:**

* Holding period less than 1 year: Gains are taxed as Short-Term Capital Gains (STCG) at 20% plus cess and surcharge.

* Holding period of 1 year or more:Gains exceeding ₹1 lakh in a financial year are taxed as Long-Term Capital Gains (LTCG) at 12.5% (without indexation).

**Debt Mutual Funds:**

* All gains are taxed as per your income tax slab, regardless of the holding period.

For further clarification, please consult your tax advisor or financial consultant.

How to Choose the Best Mutual Funds?

Define Goals:

Set clear financial goals such as retirement, home purchase, education, etc.

Assess Risk Tolerance:

Identify your risk profile — conservative, moderate, or aggressive.

Asset Allocation:

Distribute your investments across different asset classes (equity, debt, etc.) based on your risk tolerance and financial goals.

Fund Selection:

When choosing mutual funds, evaluate the following:

• Fund performance over the past 3–5 years

• Expense ratio

• Fund manager’s track record

• Risk-adjusted returns (e.g., Sharpe ratio)